This guide is built for the newbie miner or someone who’s still thinking of starting to mine. Additionally, note that we’re not talking about multi-GPU rigs or open rigs, though some gamers do prefer things that way. This guide is for gamers who have only one main gaming rig, most probably with just one GPU.

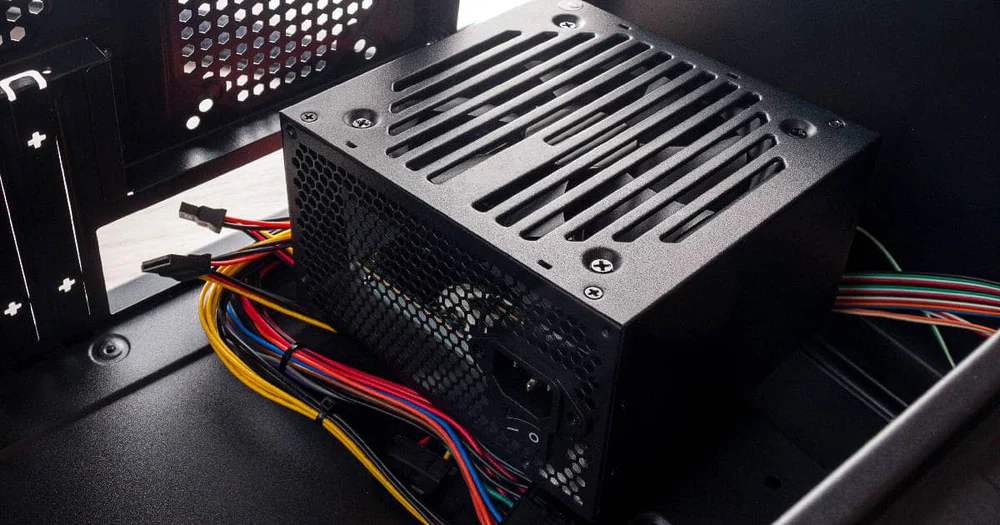

One of the most formidable enemies of gaming hardware is heat. Mining will nearly always produce more heat than gaming.

There’s no get-rich-quick scheme

Cryptocurrency mining isn’t a short-term thing. Don’t be myopic if you really want to get in. You’re better off investing in cryptocurrencies and holding (“hodling”) rather than mining if you’re looking for short-term gains. Investments are better for making profits.

Also, forget about mining Bitcoin (to be more precise, BTC – Bitcoin Core). When we say gamers can use their machines to mine cryptocurrencies, we mean all the cryptocurrencies of the world except the one that started it all: BTC.

Those who make profits mining BTC use hardware specifically meant for mining (ASIC machines) which cost a lot. And using just one ASIC machine isn’t that economical either. Mainly, miners who have been ASIC mining or mining with an entire farm of expensive GPUs for several years now are rolling in the riches. But if you try to mine Bitcoin using your machine you’ll be rolling in the ditches, and that too, very soon, because your electricity cost will go through the roof while you make $0 in a month.

Cryptocurrency mining 101

This is your guide to mining on your gaming PC. Read carefully.

Know what to mine

All cryptocurrencies aren’t the same. There are hundreds of cryptocurrencies.

- Some can be mined using GPUs – these are what you will limit your search to (Ethereum, Zcash, Litecoin, Monero, Dash, etc. – there are plenty more, less popular ones, which have the chance of becoming popular later).

- Some need specialized software like ASIC machines (Bitcoin).

- Some are mined on CPU (Monero, Electroneum, Bytecoin, etc.)

- Some coins cannot be mined at all (read PoS vs. PoW section in the end).

Token names

It’s now a good time to start familiarizing yourself with token names and not full cryptocurrency names. For example, Ethereum is actually an underlying technology. The coin is called Ether and is denoted by ETH. Familiarizing yourself with token names will save you from a lot of confusion. For example, Bitcoin has multiple forks (we’ll not get into the details of what a fork is, but consider it a breakaway token based on pretty much the same technology). BTC is Bitcoin Core (the main one), BCH is Bitcoin Cash. There’s also BSV and BCHA.

Common token names (some are easy to remember, some not so much):

- Bitcoin Core: BTC

- Ethereum main token: ETH

- Ethereum Classic: ETC

- Litecoin: LTC

- Namecoin: NMC

- Dogecoin: DOGE

- Ripple: XRP

- Dash: DASH

- Monero: XMR

- Steller: XLM

- Zcash: ZEC

- Cardano: ADA

- Polkadot: DOT

- Tron: TRX

- Uniswap: UNI

- Chainlink: LINK

- Polygon: MATIC

- Ravencoin: RVN

Check the 5,257 listed cryptocurrencies on CoinMarketCap or the 7,459 listed on CoinGecko.

It’s important to note that there are many “ecosystems” in the crypto world. These ecosystems have their own token but might additionally have other tokens as well. For example, Tron is an ecosystem that has its native cryptocurrency TRX, but also other currencies such as WIN and BTT.

Other notable ecosystems include Ethereum, NEO, Stellar, Cosmos (native token is ATOM), Cardano, Waves. These ecosystems allow different projects to be developed using their native technologies such as dApps and smart contracts.

Hash algorithm

Out of the cryptocurrencies that you can mine, you will see they use different “hash algorithms” or algorithms, simply. These algorithms are functions that need to be solved. The GPU does this mathematical work.

The speed at which a GPU can do this work is known as the hashrate. Hashrate is directly equivalent to the speed at which you can mine a certain coin.

Different cryptocurrencies are based on different algorithms. These algorithms have their own pros can cons related to technical stuff like blockchain scalability or security.

What you need to know right now is that not all hardware will give the same hashrate or speed across algorithms.

Hashrate is calculated in megahash per second (MH/s), but for some algorithms, only in H/s or KH/s.

I’ll give you an example. I currently mine a coin called Ergo. I have an AMD RX 580 8GB card. It gives 47+ MH/s hashrate for Ergo (based on the Autolykos 2 hash algorithm), but only 7 MH/s when mining Ethereum (based on the Ethash algorithm).

So, how do you prepare for this uncertainty? Read on.

Find the coin you’ll mine

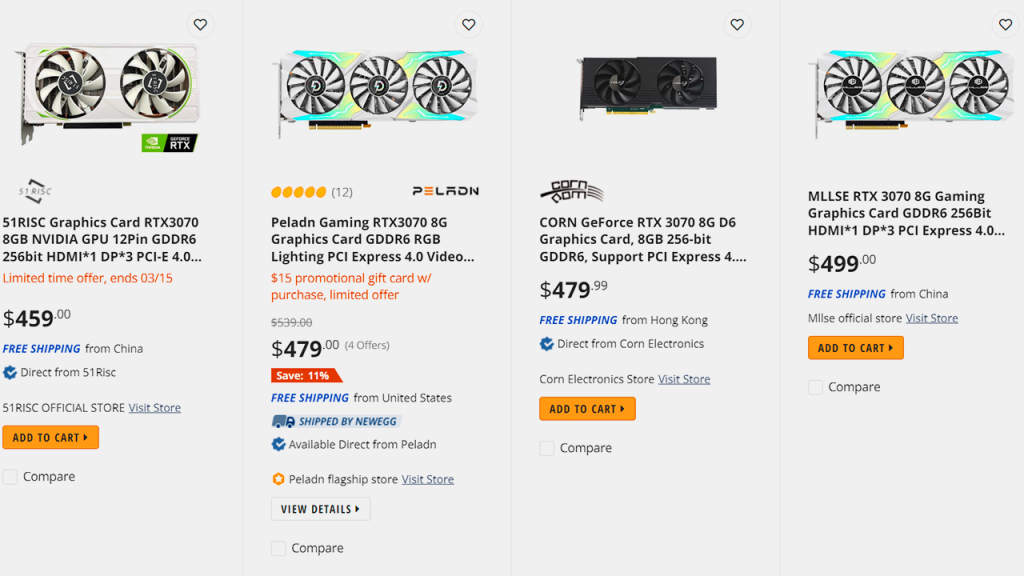

Make sure you have a decent GPU, fast RAM, and a powerful processor.

- Go to WhatToMine.com and choose your GPU. It will show you the hashrates across algorithms. Find the ones it’s highest on. Let’s image you have a 3060. WhatToMine will tell you that you can expect a 37 MH/s hashrate if you mine on Ethash vs. 42 if you mine on Octopus. Every other algorithm is giving smaller figures. So, we shortlist these two (typically, the actual hashrate is slightly lower than what WhatToMine reports).

- Next, search which cryptocurrencies are based on the shortlisted algorithms. Ethash and Octopus are both popular algorithms. Using Ethash, you can mine a number of coins like Ethereum, ETH Classic, Expanse, WhaleCoin, and so on. Using Octopus, you can mine Conflux.

- Not all coins are equal. Now, it’s time to research these coins. You’ll find that Ethereum is vastly more popular than other Ethash coins and has higher value. It beats Conflux too.

Note that the hashrates for all GPUs aren’t present on WhatToMine. You can try doing a Google search instead if you can’t find the hashrate for your GPU.

Once you have researched which coin you’ll be mining, it’s time to go back to WhatToMine and enter the electricity cost as well. It will tell you exactly which cryptocurrencies will net you how much profit (after electricity cost) if you mine all the time.

Set up your mining software

Okay, so now you know which coin will give you the best profits. Here’s what you need to know now.

- Mining literally means finding a block to be added to the blockchain. This block will now be used to withhold transactions, applications, etc. on the network.

- Block discovery rewards the block discoverer.

- You cannot solo-mine most cryptocurrencies. It’s because there’s a “difficulty” associated with mining. The more miners mining a cryptocurrency, the harder it becomes to do so (the algorithm increases in complexity). And the opposite is true as well.

- To make profits, you need to be a part of a “pool” of many miners. These pools have a combined hashrate in TH/s. A pool will find a new block sooner than a solo miner can, and all rewards are equally split among all miners.

- Choose a pool you like (they have different parameters such as minimum withdrawal limit, pool service fee percentage, etc.). Depending on which coin you wish to mine, the pool will differ as well. Do a Google search like “Ethereum mining pools” to find a suitable pool.

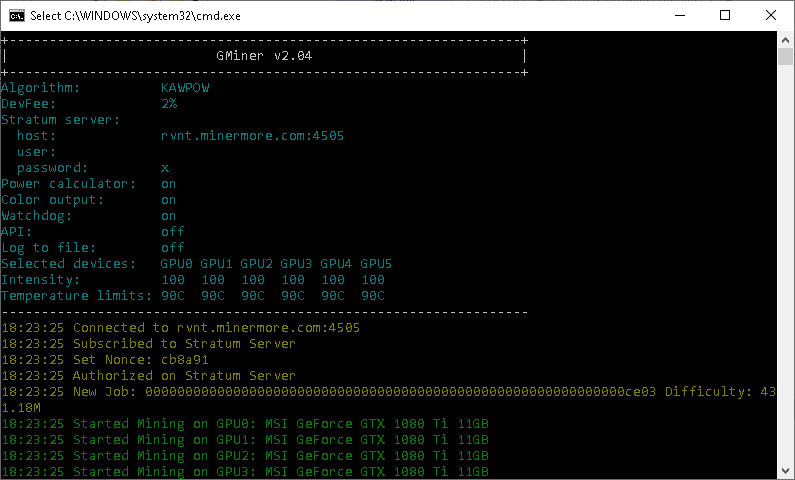

- You need mining software. Mining software are mostly Command Prompt-based script files (.exe or .bat). Many pools have their own mining software. If your pool has one, great.

- Setting up the miner is slightly complex. The miner, once downloaded, will have a bunch of files. Different mining software use different naming convention but the principle is the same: you need to provide several details such as:

- Your wallet address: AKA, where will the mined coins be sent? You need to make a wallet (it’s free) for the cryptocurrency that you wish to mine. Keep the seed phrase secret and protected.

- Which pool you wish to connect: If you choose a miner from a pool, it will come preconfigured to find the appropriate pool address. For example, if you mine on Nanominer, then the Nanominer software will automatically find the best servers to get jobs from. Otherwise, you need to copy the details from the pool website (these are usually domain names, like region.coin.com). Enter this in the miner’s configuration file as well.

- You can optionally set email, worker/rig name (if you have multiple rigs, it will be helpful), password, etc. as well.

And that’s it

Once your configuration file is correctly set up, you can launch the mining app and it will start mining. Don’t run other apps while mining. Mining might not necessarily use a lot of your resources like GPU and CPU, but it will sure heat things up.

Mining is for the long-term. You cannot expect great profits soon. Even if you’re mining ETH with five RTX 3060s, you will need to wait months to make any significant profit in fiat money.

Should you be worried about heat?

All figures in Celsius (°C).

Most people you’ll find talking about mining on Telegram groups, cryptocurrency forums, Reddit, etc. are people who haven’t owned a high-end computer before. These people might have a lot of money, but purchasing high-end gaming hardware to spend hours gaming was never their cup of tea.

To these people, 80°C GPU temperature is “Holy crap, is that normal? Why isn’t the card melting?” They make jokes such as “My cabinet gets so hot you could fry an omelet on it”. And so on.

Guys, please understand that it’s not a gaming PC if it can’t even fry omelets. That being said, mining will take your temperature higher than gaming temperature.

A GPU’s idle temperature should ideally be below 50. When it’s hard at gaming, it can reach 70 or above. When it’s mining, it can easily hit 80. In fact, it’s normal for the miner or the card to try and intentionally reach 80°C when mining to maximize the hashrate.

80+ temperature is to be avoided. Up until 80, it’s all good. You can overclock your hardware or set caps to either increase the temperature (actually, you’d be increasing the algorithm-solving speed of your GPU, and heat is just a byproduct) to reach 80 or decrease it to cap it at that.

The maximum temperature that modern GPUs can reach is 105°. After that, the computer will auto shut down. However, it’s not rare for computers to shut down due to overheating even below 100.

This usually happens during very hot days or if your airflow isn’t properly managed. Ensure that there’s plenty of open area behind your outlet fans and around the case in general.

You’re supposed to mine on your PC when it’s idle. No other app should be on, forget about games (they will be unplayable anyway). However, in case you feel like there’s some lightweight app that could be squeezed in like watching a movie on VLC or a browser or doing some work – beware. Over time, the heat might increase and you’ll end up with a system freeze, crash, or reboot.

If you still struggle with heat, a few more fans in your cabinet will solve the issue. I had to upgrade my Thermaltake Versa with two more fans apart from the three it had because I felt bad for my case getting so hot.

Is it worth it?

The dilemma will face you every time. Should I game or should I mine? Unless you’re all in and extremely serious about mining, split the time 50/50.

Whether mining is worth it or not depends on these factors:

- Your hardware: Higher-end hardware will give you a better hashrate, helping you generate more coins (or parts/shares of a coin) in a pool.

- Which cryptocurrency you’re mining: Some cryptocurrencies have many miners, in which cases its difficulty is higher, which means only very powerful rigs can economically derive a profit. Some will give you very small profits, while some might even be a loss.

- Are you in for the long run? If yes, then you can choose a cryptocurrency that has a low difficulty right now because not a lot of people are mining it. If it’s future-proof and has a great “use case” – practical usage a few years down the line, then you can definitely mine it long term and totally forget about profits for these years, because its value will increase.

Which cryptocurrencies to mine?

This is not financial advice. Cryptocurrencies are extremely volatile things. Try to do a lot of research, try to learn about many different coins and the underlying technologies, and only then make up your mind.

Currencies have a use case.

What does the network promise? For example, here are several promises made by different cryptocurrency ecosystems or blockchains:

- Enabling microtransactions with low transaction fees so that the token can be used to pay for small services and products.

- Privacy and anonymity so that you can spend your money with complete freedom.

- Ability to create smart contracts, DeFi systems, dApps, etc. that will allow users to do many different things in the future on the platform from gaming to banking.

- Fast transactions – blockchains have limits on how many transactions can be processed in a second. BTC processes 4.6 transactions per second. It means you have to wait a lot before it goes through. Other currencies can process hundreds and even thousands of transactions per second.

These are just four of the most common promises. However, different ecosystems have different use cases and milestones. You will need to read that on their own websites.

Check Cardano, Ethereum, Tron, Cosmos, Bitcoin Cash, Ripple, Monero, Litecoin, Stellar – and others. Once you start diving into any ecosystem, you will find many tokens and cryptocurrencies that can potentially hold a lot of value in the future.

Memecoins mining

There are also “memecoins”. After the surge in popularity of Dogecoin, more and more are springing up like Shiba Inu (SHIB) and Toy Poodle on Tron (TOY).

Memecoins don’t have use cases. They are memecoins. They don’t even have a well-documented website or a whitepaper. They have, in simple words, no usefulness apart from being viral, popular, comedic, or endorsed by celebrities who end up centralizing a decentralized technology.

If you’re going to mine with use cases in mind so that you not only make profits in terms of having the token, but also from the interest out of the value increase it will go through, then avoid mining memecoins.

Problems in mining

Heat is of course the #1 problem. Apart from that, there are other prominent issues as well.

- Electricity consumption: If your electricity cost is high, it’s not recommended to mine. Some coins return such a small profit that unless you have free electricity; it’s not worth mining at all.

- Price volatility: Cryptocurrencies are extremely volatile. They are shakier than stock markets. As a result, even if you’re mining for a while, the value you actually have might decrease over time if the currency’s value decreases. This can be a cause of FUD (fear, uncertainty, and doubt – FUD is what results in mass panic selling of cryptocurrencies when prices start dropping/dipping).

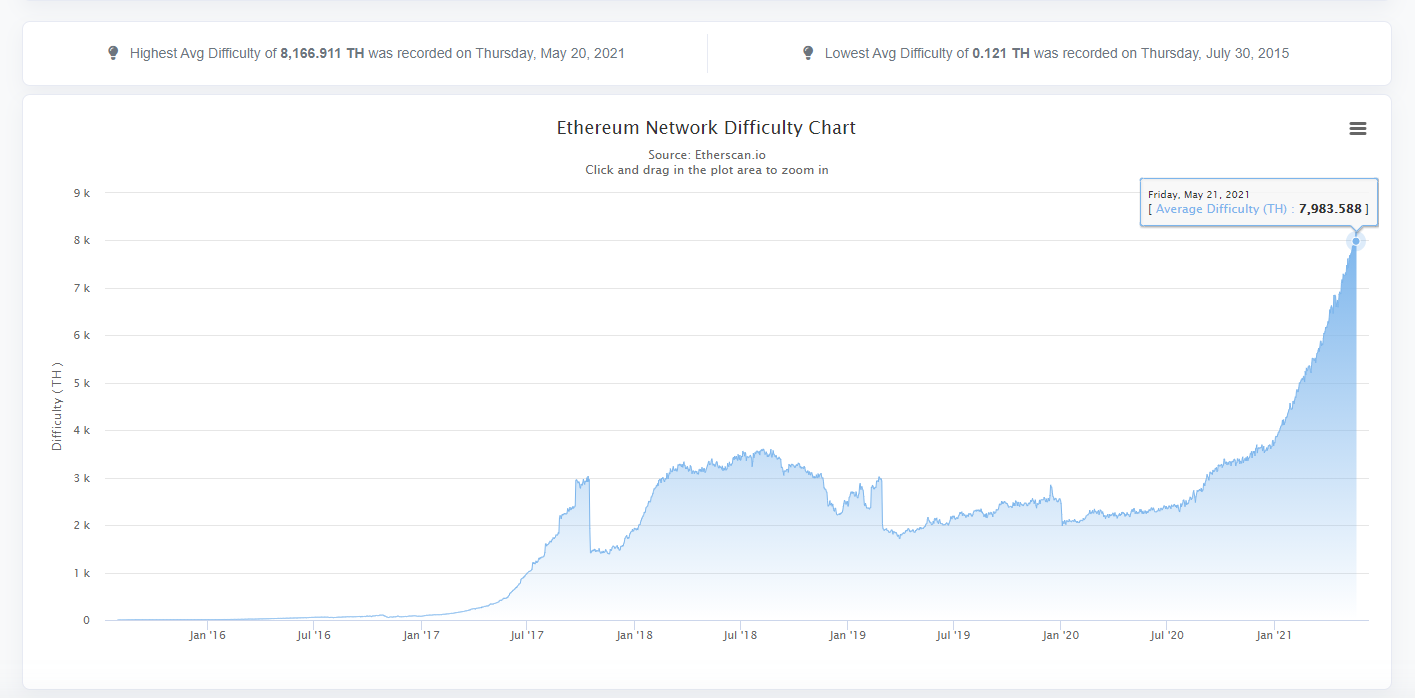

- Algorithm difficulty: As more miners join the fray, the difficulty of mining gets even higher. You can Google “coin name + mining difficulty”. For example, I’ve attached the chart of ETH’s mining difficulty below. Note how swiftly it went up. When this difficulty increases, mining becomes less lucrative and profitable because you’ll earn less. The workaround is to switch coins – you can mine anything anytime.

The real value of mining

If your vision is myopic and you want short-term profits, then mining isn’t right for you. It’s not a get rich quick scheme.

Given that you’ve done your research and you’re passionate about DeFi, blockchain technology, decentralization, or cryptocurrencies as a real-world currency in general, you know the use cases of the coins you mine.

You believe in those coins.

And from this belief stems the hope that your mined coins will hold considerably higher value in the future. The endgame here is being confident that the ideal cryptocurrencies will have higher value than the USD, more influence than it, and much safer and widespread usage all across the globe.

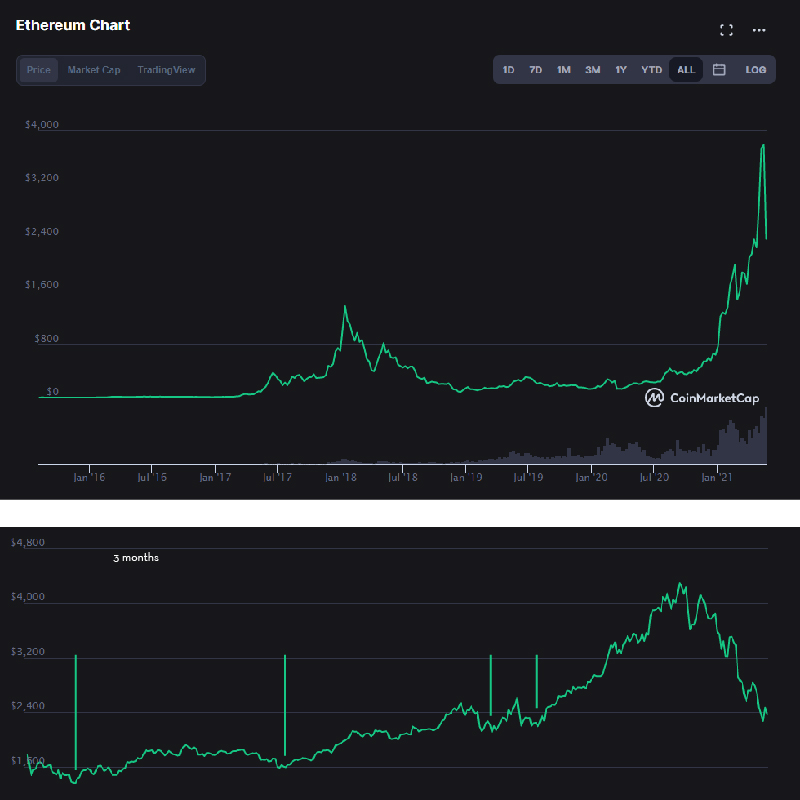

See the all-time chart of any major cryptocurrency. Most likely, it remained very low-value for a very long time, but then steadily increased its value to be 10, 15, or even 100 times of what it was before.

Good cryptocurrencies with good use cases will always grow. Even if their prices suffer blows (major dips), they will always recover and reach a higher price than ever before because the underlying technology will not change, but only improve.

That brings us to the climax. When you mine a lot and build up a strong portfolio, the value of that portfolio will also steadily increase.

Assume you’re mining coin X. Coin X is valued at 50 cents per coin. You keep mining day and night, and build a portfolio that’s 50-coins strong. This portfolio is valued only at $25. But in parallel, the value of the coin is also increasing. If it becomes $1 per coin, then your portfolio will suddenly jump to a value of $50. If it sees a 200% growth in 2 years, then that means your money also sees a 200% growth.

Of course, this is a simplified example. Price jumps aren’t instant. In addition, you won’t have only 50 coins throughout the 2 years in the above example. Your actual coin count will also increase, thus reaping you even more profits.

Recommended currencies

This is a personal opinion section, so feel free to skip it. You have all you need to start. Get them coins!

I highly recommend gamers with higher-end GPUs (Nvidia 30-series or the AMD 6000-series) to mine Ethereum. Even when ETH switches over to PoS, your rig will be able to mine other cryptocurrencies. It will help you greatly to have a considerable amount of ETH in your wallet. Perhaps, you can stake as well when the transition (called The Merge, as part of the Eth2 or Eth 2.0 update) happens – though it requires 32 ETH, which is too much and impossible to mine if you’re just getting into it. Eth2 staking is already happening.

If you have a Threadripper CPU, you might want to mine XMR (Monero). XMR is a promising crypto ecosystem that allows completely private and untraceable transactions on its blockchain. No other popular cryptocurrency provides this level of privacy. As privacy is always in demand, you can expect XMR to make great profits for you.

Currently, the tokens that are giving the most profit for GPU miners are ETH (on Nicehash.com, as well as on other pools), MWC, ERG, ETC, FIRO, TUBE, RVN, ZANO, CCX, XEQ, and VTC. The ones higher up on the list are for higher-end GPUs. The ones in the last are for lower-end GPUs.

Other options to research: CFX, XWP, RYO, TENT, AE, FLUX, BEAM.

Complimentary reading: PoW vs. PoS

There are two major types of consensus: Proof of Work and Proof of Stake. Cryptocurrencies work on creating and validating blocks. This can be done in two ways. There are also other ways (like CHIA uses Proof of Time and Space; HNT uses Proof of Coverage, etc.), but PoW and PoS are the most widely used.

Proof of Work, or PoW, is the more conventional and common method. In this method, miners use mining software to compute complex algorithms. If you’re reading this article then that means you’re only interested in PoW coins.

Work is done by solving these algorithms. This process verifies and validates block creation. As a result, a group will need to have more than 50% of the total mining power of a coin to attack it. This is why cryptocurrencies are termed highly secure – they are so decentralized that launching an attack will be a fool’s errand.

However, the downside is that over time and in total, mining to do this work costs a lot of electricity. Bitcoin mining, for example, uses 113.89 TWh/year. This is more electricity consumption than that of many countries taken together. Using this much electricity just to confirm blocks is always an aspect of cryptocurrencies that’s criticized. But this is the best we have. Or is it?

Enter Proof of Stake. This isn’t for miners. In a PoS system, you will hold your coins in your wallet and stake them. Staking your coin will render them unusable, unless you take them out of the stake.

All stakers are given jobs like validating blocks or voting. Sometimes, there are no jobs. You simply receive dividends and rewards for staking your coins. PoS coins cannot be mined. There are variations of PoS.

Typical PoS coins include ADA (Cardano), ATOM (Cosmos), WAVES, ARK, etc. There are variations such as in Tron, you don’t stake your coins but you freeze them (unable to use) and vote for “Super Representatives” or SRs. These SRs are responsible for mining the actual blocks on the Tron network. As a reward, they give small incentives to all those who have frozen their TRX (Tron’s token) in order to vote for them.

ETH is currently GPU-mineable, but it’s soon transitioning to PoS. If all miners don’t make the transition and stop mining ETH, it might result in a fork.